Grocery prices increased by 13.5% in August compared to 2021. | Unsplash/Viki Mohamad

Grocery prices increased by 13.5% in August compared to 2021. | Unsplash/Viki Mohamad

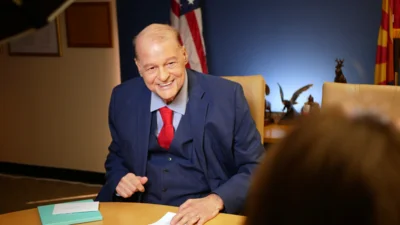

Ballotpedia reported the most recent Scott Rasmussen Number of the Day poll finds that a majority of voters have experienced grocery prices and gas prices rising in the past month. Economists are predicting a recession is coming and inflation is not going away anytime soon. Some economists say inflation is tied to government spending, supply chain logistics and the war in Ukraine. Sen. Mark Kelly (D-AZ) has historically supported many of the spending bills under the Biden administration.

A report from the Committee for a Responsible Federal Budget found in its first two years, the Biden administration has added $4.8 trillion to the national debt through government spending bills. The Committee acknowledged spending bills that helped Americans financially during the pandemic but the government continued to add to the deficit. The Committee claims excessive spending has led to the inflationary pressures on the U.S. economy, including the American Rescue Plan, the FY 2022 Omnibus Bill, the Bipartisan Infrastructure Law, the Honoring our PACT 2022 bill, the SNAP Food Stamps Increase, Health Related Executive Orders, CHIPS and Science Act, Aid to Ukraine bills and Student Debt Relief. The Committee says the Inflation Reduction Act reduced the deficit by $240 billion to bring a total of $4.8 trillion in spending under the Biden administration. Kelly voted "yes" on all the aforementioned legislative bills, according to Vote Smart.

Ballotpedia’s most recent Scott Rasmussen Number of the Day shows 76% of voters have seen their grocery prices go up in the last month. The poll also found 60% of voters believe prices will continue to rise. Additionally, 54% of voters say gas prices have gone up in the last month and 59% believe gas prices will continue to go up. Ballotpedia’s poll methodology surveyed 1,200 registered voters from Oct. 6-8. According to the Ballotpedia website, the poll was lightly weighted by geography, gender, age, race, education, internet usage and political party to reflect a fair balance of voters across the country. The margin of sampling error is +/- 2.8 percentage points.

The U.S. Bureau of Labor Statistics issued its latest Consumer Price Index (CPI) summary for the nation on Oct. 13, which found that the rate of inflation over the last 12 months stands at 8.2%. It rose 0.4% in September. In the last year, food costs have risen by 11.2%, energy costs have increased by 19.8%, gas prices have risen by 18.2% and the cost to purchase a new vehicle has increased by 9.4%. According to SmartAsset, economists say inflation is largely tied to increased federal government spending.

CNBC reports that Jaime Dimon, CEO of JP Morgan Chase, the largest bank in the U.S., warned a recession is likely imminent in the next six to nine months. Dimon said the factors contributing to a future recession were record inflation and continuous increases in interest rates, as well as the unknown effects of the Russia-Ukrainian war.

“But you can’t talk about the economy without talking about stuff in the future — and this is serious stuff,” Dimon told CNBC.

The Federal Reserve has been raising interest rates to combat inflation, but Chicago Federal Reserve President Charles Evans is concerned the Fed may be raising interest rates too fast. The Fed has confirmed they will continue to increase interest rates to 3.25%. Dimon warned to be prepared for the recession to hit hard but said there are important factors relating to the war in Ukraine and what comes from it.

The Wall Street Journal’s survey of 66 economists also reported a recession is likely coming in the next 12 months. The WSJ now predicts a 63% chance of a recession, compared to 49% in July. In 2023, gross domestic product is expected to have negative growth in the first two quarters. Economists predict GDP will contract 0.2% at an annual rate in the first quarter and 0.1% in the second. Economists predict job cuts and payroll declines. The WSJ says 58.9% of economists believe the Fed is raising interest rates too fast, predicting interest rates will climb to 4.551% in June of 2023.

“‘Soft landing’ will likely remain a mythical outcome that never actually comes to pass,” said Daniil Manaenkov, an economist at the University of Michigan. The WSJ explains a "soft landing" would be when the Fed raises interest rates enough to curb inflation without tipping into recession.

Aneta Markowska, chief economist at Jefferies LLC said, “The coming drag from higher rates and stronger dollar is enormous and will knock off about 2.5 percentage points from next year’s GDP…in light of this, it’s hard to imagine how the U.S. can avoid a recession.” WSJ economists also expect unemployment to rise and home prices to decline by 2.2%, the greatest decline since 2011.

CNN reports food prices are not coming down and will likely continue to go up into 2023. Grocery prices increased by 13.5% in August compared to 2021, which CNN says in the largest annual percentage increase since 1979. Inflation on food prices is predicted to remain steady in 2023 but CNN says prices will likely not decrease due to the unknown outcome of the war in Ukraine, under-production of crops from weather and disease and the continual rise of inflation.

The president of client engagement at market research company IRI, KK Davey, told CNN: “Producers aren’t ‘seeing any end to inflation in terms of their labor and commodities cost,’” and IRI expects an increasing inflation rate of 5-10% in 2023. According to CNN, a natural increase of food prices is normal, usually from 2-3% every year, but General Mills (GIS) food company, which makes Cheerios, expected a 14-15% increase in FY 2023. According to David Ortega, food economist and associate professor at Michigan State University, normal increases in food prices do not harm consumers because they match with wage increases. This is not the case currently, CNN reports because according to Ortega, “consumer prices are increasing faster than wages are increasing. What we’re seeing now is really a cost of living crisis.”

Along with food prices, gasoline prices are back on the rise after declining the last couple months due to the Biden administration’s decision to tap into the Strategic Petroleum Reserve, says the WSJ. Analysts say gas prices will increase due to OPEC’s decision to cut 2 million barrels of oil per day. Richard Joswick, head of global oil analytics at S&P Global Platts, told the WSJ prices are unusually high as normally fuel producers adjust to winter-grade fuel blended with butane, which is cheaper to produce, as well as cheaper for consumers. The average price of gasoline as of Oct. 21 is $3.820, up from $3.681 a month ago, according to the American Automobile Association (AAA).

The latest Gasoline Misery Index in Arizona, which tracks how much more (or less) the average American consumer will have to spend on gasoline on an annualized basis, reports that the average Arizonian is spending around $509 more on gas this year when compared to the same time a year ago. The Gas Misery Index also reports Americans are spending $738 more on gas today than when President Joe Biden took office.

Alerts Sign-up

Alerts Sign-up